Albuquerque First Time Homebuyer Program

Many Albuquerque First Time Home Buyers struggle to come up with a down payment when getting ready to buy a home. To help these individuals realize their dream of being  homeowners, the New Mexico Mortgage Finance Authority (MFA) offers first-time home buyer programs to qualified individuals and couples called the “FIRSTHome and FIRSTDown program”. Here’s what you need to know to take advantage of this great program. We’ll answer important questions, including:

homeowners, the New Mexico Mortgage Finance Authority (MFA) offers first-time home buyer programs to qualified individuals and couples called the “FIRSTHome and FIRSTDown program”. Here’s what you need to know to take advantage of this great program. We’ll answer important questions, including:

- What type of loan is available?

- Who qualifies?

- What type of home Qualifies for the Buyer Assistance Loan?

- How do these housing loans help?

- Why Choose Myers & Myers Real Estate?

- How to buy a house?

We help the first-time homebuyer realize an exceptional opportunity to move into a home through the MFA $500 FIRSTHome move-in program. Below is a list of the most common questions asked.

What Type Of Loan is Available For The First-time Homebuyer Programs?

For first-time homebuyers in New Mexico, the Mortgage Finance Authority (MFA) offers a primary loan program called FirstHome, which provides affordable, fixed-rate loans. This loan can be paired with a down payment and closing cost assistance program to help reduce upfront expenses, making it easier for buyers to enter the housing market.

In addition to FirstHome, MFA provides a down payment assistance program through FirstDown and HomeNow, which are second loans that can be used to cover down payment and closing costs. The FirstDown program is available for moderate-income buyers, while HomeNow is geared towards those below 80% of the area median income. The program can be combined with FHA, VA, USDA, or conventional loans, giving first-time buyers the flexibility to choose the type that best suits their financial situation.

First-time Home Buyers – Who Qualifies?

In New Mexico, the Mortgage Finance Authority (MFA) defines a first-time homebuyer as someone who has not owned and occupied a primary residence in the past three years. To qualify for MFA’s FirstHome program, applicants must meet specific criteria:

- Income Limits: Household income must not exceed the county and household size limits. For example, in Bernalillo County, the limit is $91,565 for a 1-2 person household and $105,300 for a household of three or more.

- Purchase Price Limits: The home’s purchase price must be within the area’s specified limit.

- Credit Score: A minimum credit score of 620 is required to qualify for a loan.

- Homebuyer Education: A pre-purchase counseling course must be completed through MFA’s online program, eHome America, or a HUD-approved counseling agency.

- Primary Residence: The property must be the buyer’s primary residence within 60 days of closing.

These loan requirements ensure that the programs assist eligible homebuyers in achieving homeownership.

What Homes Qualify?

In New Mexico, the Mortgage Finance Authority’s (MFA) FirstHome housing assistance is designed to help homebuyers purchase various residences. Eligible property types include:

- Single-Family Detached Homes: Standalone residential properties suitable for individual families.

- Townhomes and Condominiums: Multi-unit properties where individuals own their specific units.

- Homes in Planned Unit Developments (PUDs): Properties within communities that may offer shared amenities and are governed by homeowners’ associations.

- Manufactured Homes: A Multi-wide manufactured home permanently attached to a foundation and assessed as real property.

It’s important to note that these properties must be the buyer’s primary residence and cannot be intended for income generation. Additionally, purchase price limits for housing assistance vary by county. Prospective buyers should ensure the property they are interested in falls within these guidelines to qualify for the First Home program.

How These Housing Loans Help First-Time Homebuyers?

Loans and assistance programs are crucial in helping New Mexico first-time homebuyers achieve their dreams of homeownership. These programs are designed to make buying a home more accessible, often by addressing the most significant barriers, such as the down payment and closing costs. For instance, the New Mexico Mortgage Finance Authority’s (MFA) FirstHome program provides an affordable loan option for those entering the housing market for the first time, making loans more manageable with fixed, lower interest rates. The MFA also partners with various local resources to offer additional housing assistance, enabling homebuyers assistance to find a suitable home without overwhelming financial strain.

For homebuyers with limited savings or lower credit, housing assistance programs can be a game-changer, offering solutions to meet the specific financial needs of new homeowners. Down payment assistance is a common feature, allowing buyers to reduce upfront costs and make homeownership achievable sooner than they might otherwise. Many of these programs are compatible with an FHA loan, a popular option for first-time buyers due to its lower credit score requirements and reduced down payment thresholds. New buyers can also explore city-specific assistance programs, providing additional resources tailored to local housing markets and ensuring access to affordable housing options that fit their budget.

These programs are not just about financial support; they also provide guidance and education on navigating the home buying process. New buyers can learn about the different types of loans available, including standard loans and specific loans designed for first-time buyers. With the right loan and assistance programs, buyers gain confidence as they enter the housing market, equipped with the knowledge and support they need. Ultimately, loans and housing assistance programs create a path to secure, stable homeownership, turning the dream of a new home into a reality for many first-time buyers.

First-time Home Buyer Assistance Program – Why Choose Myers & Myers Real Estate

Buying your first home can be daunting. It helps to have an experienced Realtor® on your side to guide you through everything from finding a great home to applying for the FIRSTHome grant. At Myers & Myers Real Estate, we’ve helped numerous people through the process. We’ll guide you through securing financing, searching for your dream home, negotiating terms and conditions, and handling all the details of the home-buying process.

Our foremost goal is to provide you with exceptional customer service. We assist you in buying your first home right neighborhood to fit your lifestyle and needs. Please utilize our real estate expertise to make your home search and buying your first home as stress-free and rewarding as possible. Call us today at 505 401-7500 so we can help you participate in the home loans program!

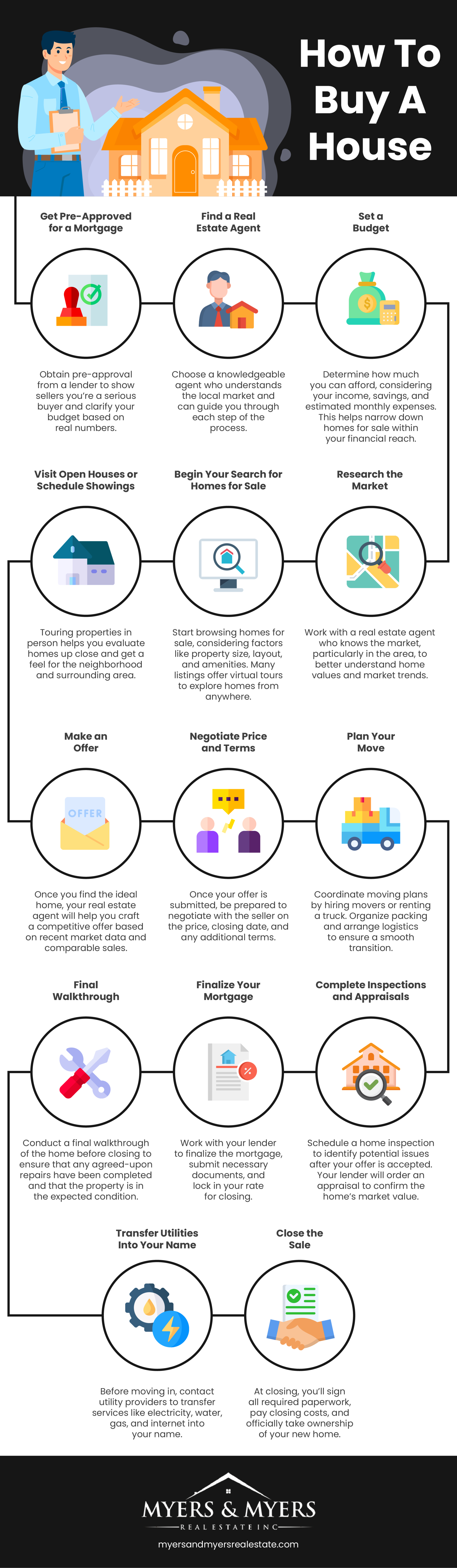

Tips To Buy A House With The First Time Homebuyer Programs

- Get Pre-Approved for a Loan: Obtain a loan pre-approval from a lender specializing in first-time home buyer programs. We collaborate with New Mexico’s top lender for first-time homebuyer programs. Call us today at 505-401-7500.

- Find a Real Estate Agent: Choose a knowledgeable agent with experience working with the first-time homebuyer program. We love working with first-time homebuyers and have helped hundreds of people purchase their first home.

- Set a Budget: Determine how much you can afford, considering your income, savings, and estimated monthly expenses. This will help you narrow down a home for within your financial reach.

- Research the Market: Work with a real estate agent who knows the housing market, particularly in the area, to understand home values and market trends better.

- Begin Your Home Search: Start browsing for your dream home, considering factors like property size, layout, and amenities. Many listings offer virtual tours to explore your first home

- Schedule Showings: Touring properties in person helps you evaluate homes up close and get a feel for the neighborhood and surrounding area.

- Make an Offer: Once you find the ideal home, your real estate agent will help you craft a competitive offer based on recent market data and comparable sales.

- Negotiate Price and Terms: Once your offer is submitted, be prepared to negotiate with the seller on the price, closing date, and any additional terms.

- Plan Your Move: Coordinate moving plans by hiring movers or renting a truck. Organize packing and arrange logistics to ensure a smooth transition.

- Complete Inspections and Appraisals: Schedule a home inspection to identify potential issues after your offer is accepted. An appraisal will confirm the home’s market value.

- Finalize Your Loan: Work with your lender to finalize the loan and submit the necessary documents.

- Final Walkthrough: Conduct a final walkthrough of the home before closing to ensure that any agreed-upon repairs have been completed and that the property is in the expected condition.

- Transfer Utilities Into Your Name: Before moving in, contact utility providers to transfer services like electricity, water, gas, and internet into your name.

- Close the Sale: At closing, you’ll sign all required paperwork, pay closing costs, and officially take ownership of your new home. Congratulations, you are a homeowner and on your way to creating home equity.

Check out these popular areas and use our easy SEARCH TOOLS to start searching for your first home today!

Reviews

Frequently Asked Questions - FAQs About First-time Buyer Programs

Q: What are the qualifications for being a first-time home buyer in New Mexico?

A: To qualify as a first-time homebuyer in New Mexico, you must not have owned a primary residence in the past three years. Additional requirements include meeting income and purchase price limits, a minimum credit score 620, and completing a homebuyer education course.

Q: What is the $500 down payment assistance program in New Mexico?

A: In New Mexico, the Mortgage Finance Authority (MFA) offers programs that enable qualified homebuyers to purchase a home with as little as $500 of their funds. These programs provide down payment and closing cost assistance, making homeownership more accessible.

Q: What credit score is needed for the first-time home buyer program in New Mexico?

A: In New Mexico, the Mortgage Finance Authority (MFA) requires a minimum credit score of 620 for its FirstHome program, which assists first-time homebuyers. If your credit is low, call us at 505 401-7500, and we will connect you with a credit repair expert.